Apple Earnings: Astonishingly Good

Summary

- For its fiscal 2015 Q2 earnings, Apple posted a 27.5% y/y increase in revenue and a 30% y/y increase in operating income.

- Apple's growth has been fueled by the continuing success of the iPhone 6 and the company's rapid expansion in emerging markets, especially China.

- I expect iPhone 6 sales momentum to be only slightly impacted by competing phones such as the Samsung Galaxy S6.

Companies the size of Apple (NASDAQ:AAPL) aren't supposed to grow by roughly 30% y/y. The reason Apple shouldn't be growing so fast has something to do with the Law of Large Numbers. Apple has now violated that "law" for the past two quarters. Perhaps that's why the analysts on the conference call seemed so subdued. They were still getting over their shock.

By the Numbers

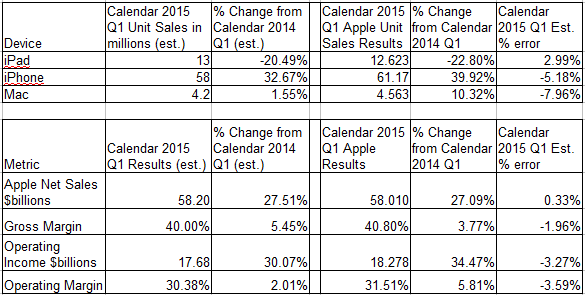

Apple's fiscal 2015 Q2 financial results came in just about where I expected. Below are the results summarized against predictions from my pre-earnings article.

These results came in far above analysts' latest estimates, compiled by Philip Elmer-DeWitt the morning of the earnings report. The analyst average was for $55.7 billion in revenue and unit sales of 55.8 million iPhones. For those who are interested, the error in my estimate for iPhone unit sales was more or less balanced by my overestimate in iPhone ASP.

For me, my estimates were close enough to the actual numbers that the interesting part of the conference call were the announcements and Q&A.

As many expected, Apple announced an expansion of its capital return program. The program will be increased 50% to $200 billion through March 2017. Apple increased the quarterly dividend to $.52/share, and increased the share repurchase program to $140 billion. Share repurchase funds were about to run out, with $80 billion of the $90 billion allocated already spent.

I haven't been a big fan of the capital return program. It seems mostly geared toward placating institutional investors, and has been funded in part by debt. However, it appears to have had a salutary effect on the company's stock price, so I can't complain too much. It's certainly indicative of Apple management's confidence in the future that they would be willing to buy back so much stock at the current price level, which shot past the 52-week high after-hours.

I prefer to see Apple investing in ways to improve its competitive position, but that seems to be happening at a rapid pace. CEO Tim Cook emphasized the numerous strategic investments that the company is making (without being very specific), including 27 acquisitions in the past six quarters and rapid retail expansion in China.

Its performance in Greater China can take almost as much credit for the spectacular quarter as the iPhone itself. Cook offered a lot of additional information on how the company is doing in China, which was not included in the press release. Apple now has 21 stores in China, and plans to have 40 by the middle of next year. Greater China revenue was up 71% y/y, contributing to Apple's 58% growth in emerging markets. The iOS App store had over 100% y/y growth in China. Even the Mac is doing well in China, with 31% y/y growth.

The company is also rapidly expanding its R&D spending, which has grown to $1.92 billion, a 34.9% y/y increase. This caused one analyst to wonder what Apple might have in store in the future. The company admitted that it needed the additional R&D to support its broader product portfolio, and that it is investing in "foundational technologies."

My view has been that Apple skimped on R&D for years under Jobs, and is just now starting to catch up. This quarter, R&D made up only 3.31% of revenue. In contrast, Microsoft (NASDAQ:MSFT), Intel (NASDAQ:INTC) and Google (GOOG, GOOGL) all spend a higher percentage of revenue on R&D, and more in absolute terms:

|

Company |

Apple |

|||

|

R&D Cost $ billions |

1.92 |

2.98 |

2.75 |

3.00 |

|

R&D % of Revenue |

3.31 |

13.73 |

15.90 |

23.40 |

Does higher R&D spending guarantee innovation? Of course not, but it does usually increase the probability of achieving innovation.

Apple Watch: Enthusiasm Curbed

Not surprisingly, we weren't gifted with specific sales information about the Apple Watch. One analyst even noted that there seemed to be a lack of enthusiasm in the statements being made by Apple management about the Watch after the opening weekend.

Cook did allow that it was difficult to gauge demand for the Watch when supply was so short of demand. Given what happened with pre-orders and the lack of availability of stock in Apple stores, my take on the situation is that Cook is just a little frustrated with his supply chain right now.

Based on the teardown I have seen of the Watch, I can understand why the supply is very limited. The Apple Watch is probably more difficult and costly to assemble than an iPhone. Apple also allowed that gross margin for the Watch will be lower than the corporate average, not just the iPhone, which is saying a lot.

Given the supply constraint, it's understandable that Apple chose not to release any Watch sales figures. Such figures would have been immediately seized upon as proof that the Watch is a flop. Apple expects to have stock available in stores in June, indicating rough supply-demand balance by the end of the quarter. I fully expect the company to report Watch sales numbers for the June quarter.

Looking Ahead

The midpoint of Apple's revenue guidance ($46-48 billion) represents a 27% y/y increase, with gross margin only declining slightly to 38.5-39.5%. Clearly, Apple is not expecting the bottom to fall out of the iPhone market, although many bears are, due to the Samsung (OTC:SSNLF) Galaxy S6.

The S6 is a good phone - probably the best Android phone out there. By most benchmarks and real-world tests, it's a little faster than the iPhone

6. Should Apple investors be alarmed?

Not really. As nice as it is compared to previous Samsung smartphones, the S6 is not going to win over converts from the iOS. The styling is just too derivative of the iPhone, and the slight performance advantage is not enough to incite envy in an iPhone 6 user. But the S6 will sell well to Android users looking to upgrade, and Samsung should recover considerable market share as a result. It may reduce the number of defections from Android, which will be the extent of its impact on iPhone sales.

In effect, Apple and Samsung sell into separate markets, which interact only weakly. The walls between the iOS and Android ecosystems are sufficiently high that neither has to greatly fear loss of users to the other. But Apple's strategy in China may prove the more effective in recruiting new iOS users.

According to Cook, the rapid expansion of the middle class in China is what's fueling Apple iPhone sales. As people become more affluent, they are tossing their white-box Android phones for something more upscale. Apple has intelligently positioned itself as that upscale alternative. Apple's retail presence in China, the beauty and elegance of its stores, serve to reinforce the upscale perception.

Rather than going downmarket, Apple is letting the market come to it.

Editor's Note: This article discusses one or more securities that do not trade on a major U.S. exchange. Please be aware of the risks associated with these stocks.

Πηγή: seekingalpha.com

17

- Επισκόπηση των, μέχρι σήμερα, δημοσιευθέντων αποτελεσμάτων για τη χρήση του 2023

- Το επενδυτικό σχόλιο του κ. Γιάννη Σιάτρα, θα δημοσιευθεί, αύριο το πρωί, στις 9:00 πμ.

- Data centers: Ποιες εταιρείες πρωταγωνιστούν – Ο χάρτης της ελληνικής αγοράς

- Βιομηχανία: Βουτιά 7,4% στις τιμές παραγωγού στην Ελλάδα τον Δεκέμβριο

- Δεύτερο «μέτωπο» στη ναυτιλία ο Ινδικός Ωκεανός μετά την Ερυθρά Θάλασσα - Η αύξηση περιστατικών πειρατείας προκαλεί ανησυχία

- Γιώργος Μυλωνάς (Alumil): Είμαι σε ομηρία από τους servicers- Πνίγουν τις υγιείς επιχειρήσεις

- Επισκόπηση των, μέχρι σήμερα, δημοσιευθέντων αποτελεσμάτων για τη χρήση του 2023

- Data centers: Ποιες εταιρείες πρωταγωνιστούν – Ο χάρτης της ελληνικής αγοράς

- Βιομηχανία: Βουτιά 7,4% στις τιμές παραγωγού στην Ελλάδα τον Δεκέμβριο

- Δεύτερο «μέτωπο» στη ναυτιλία ο Ινδικός Ωκεανός μετά την Ερυθρά Θάλασσα - Η αύξηση περιστατικών πειρατείας προκαλεί ανησυχία

Σχολιάστε το άρθρο